Pico Agriviet Company

CHINA'S DEAL TO IMPORT BRAZILIAN CORN COULD RELIEVE TIGHTENING DOMESTIC SUPPLIES

Pico Agriviet

![]()

Dalian July corn futures fell to USD433/mt on May 25, 2022, down USD10/mt at the beginning of the trading week. China's agreement to import Brazilian maize was the most significant factor spurring the downward price trend. The deal comes as effort of the Chinese government to a secure sufficient grain supply on the domestic market, Ukrainian as exports remain paralyzed amid the Black Sea charity.

China and Brazil have agreed upon quarantine and phytosanitary requirements of corn imports to China on W4 May 2022. It could take three to four months before China can import Brazilian maize because the Chinese Ministry of Agriculture must still approve the deal. Besides, both countries must still find common ground in the genetically-modified varieties of corn that will be allowed to enter the Chinese market. Unconformity with Chinese genetically modified corn standards has been hindering Brazilian maize imports over the last five years.

The news about the signed deal has put downward price pressure on the Chinese and International Markets. For China, the agreement would mean a possible relief from the tightening corn stocks and feed supply security, given the forecasts for higher domestic corn use and dwindling ending stocks in 2022-23. According to Chinese Agricultural Demand and Supply Estimates, domestic corn consumption for 2022-23 is expected to reach 290.31 million mt, 1% more than in 2021-22. National endings stocks are projected at 40,000 mt in 2022-23million mt, down 99% YoY.

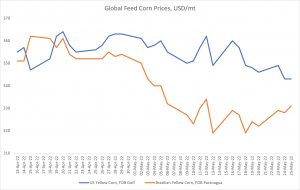

Source: IGC

The agreement could mean lower exports in the next season for the US, the major corn supplier to China, as American trader will be competing with cheaper Brazilian grain. The increase in the rivalry between US and Brazil for the Chinese market could result in lower US price corn offers. Over the last three weeks, the price difference between US and Brazilian corn has wonderful from USD20//t to USD10/mt. As of May 25, Brazilian corn prices ranged between USD330-337/mt FOB Paranagua, while US corn offers ranged from USD340-350/mt FOB Gulf of Mexico.

Written by